Value added tax calculation

You sold the goods for INR 750 lakhs and the output tax is payable at 10 of the total income. The VAT rate in the country is 20 and there are no other taxes on goods or services.

Value Added Tax Explained What Is Vat And How To Calculate It Place Card Holders Value Added Tax Add Tax

Output VAT 3750.

. Calculating the Finance Charge Finance Charge Capital invested WACC and WACC KeE ED Kd 1-tD ED where Ke required return on equity and Kd 1-t. The summation method the deduction method and the credit method. Definition of Value Added Tax.

Since the manufacturer spent 30000 Naira to buy the raw materials for the phone production 75 of that amount is called the input VAT. App for Calculating VAT GRA Online Tools Tax Calculators Value Added Tax Value Added Tax Please enter the Payment Amount and select the check if the value includes VAT NHIL and. Therefore the output tax is INR.

We want to add VAT to the net amount to get the gross. The formula to be used is 1VAT percentage X the net. App for Calculating VAT GRA Online Tools Tax Calculators Value Added Tax Value Added Tax Please enter the Payment Amount and select the check if the value includes VAT NHIL and.

Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF and NSSF Contribution. You can calculate the VAT paid at each stage in the production of an item by subtracting the previously charged VAT from the most recent stages VAT. Simply enter the sale amount the local VAT rate the select.

Value Added Tax VAT is a consumption tax levied on goods at every stage of the manufacturing process from labor and raw materials to the final sale. Tax is calculated based on the value addition and not on the sale value. We can use three methods to calculate the VAT liability.

Input VAT 75 of 30000. To find how much it will cost with vat included youll need to enter this into the calculator. It is determined by calculating the difference between allowable purchases and revenue.

Value-Added Tax VAT Calculator. The standard way to implement a value-added tax involves assuming a business owes some fraction on the price of the product minus all taxes previously paid on the good. These formulas can easily be used for example to calculate the value added tax in Excel sheets.

The net price is. The amount of VAT paid by the user is. Value Added Tax Calculator Home Business VAT VAT Calculator This calculator makes it easy to quickly calculate VAT on a sale.

Thus value-added as the basis of value-added. Excl100 x VAT Calculate the VAT backwards a formula to exclude the tax amount. This means you paid INR 50000 as the input tax.

A value-added tax VAT or goods and services tax GST is an indirect tax in Europe Japan and many other countries on spending on goods and services. Value Added Tax popularly known as VAT is an Indirect Tax levied on each stage of production until end consumption based on the value-added at each stage. Calculate VAT and include the tax amount.

How to Calculate VAT and reverse VAT. Now your receipt is probably more understandable. Value Added Tax was introduced in 1973 as a replacement for Purchase Tax and Selective Employment Tax as a condition of UK entry into the European Economic Community.

Lets consider that the net price of our sales is 100000frs and our VAT is 1925.

Download Revenue Per Employee Calculator Excel Template Exceldatapro Excel Shortcuts Metric Excel Templates

A Guide To Understanding Value Added Tax Vat Certified Accountant Accounting Education Supplies

The Objective Of The Goods And Service Tax Gst Is To Eliminate Cascading Effect Of Indirect Taxe Goods And Service Tax Accounting And Finance Study Solutions

Vat Vs Gst Infographic Simple Flow Chart Infographic Goods And Services

Vat Registration Threshold Calculation In Uae Vat Consultants In Dubai Uae Tax Debt Indirect Tax Seo

Download Saudi Vat Payable Calculator Excel Template Exceldatapro Excel Templates Templates Calculator

Accounting Services In Dubai And Audit Services In Dubai Accounting Services Audit Services Accounting Firms

Simple Interest Vs Compound Interest Top 8 Differences To Learn Simple Interest Compound Interest Maths Solutions

Automatic Tax Calculation Tax Creative Professional Accounting

Value Added Tax Meaning I Value Added Tax Example I Gst In 2022 Meant To Be My Values Memes

General Tax Calculation Invoice Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Template Net Invoice Template Invoice Design Template Google Sheets

Ev To Ebitda Meaning Formula Interpretation And More Enterprise Value Money Management Advice Learn Accounting

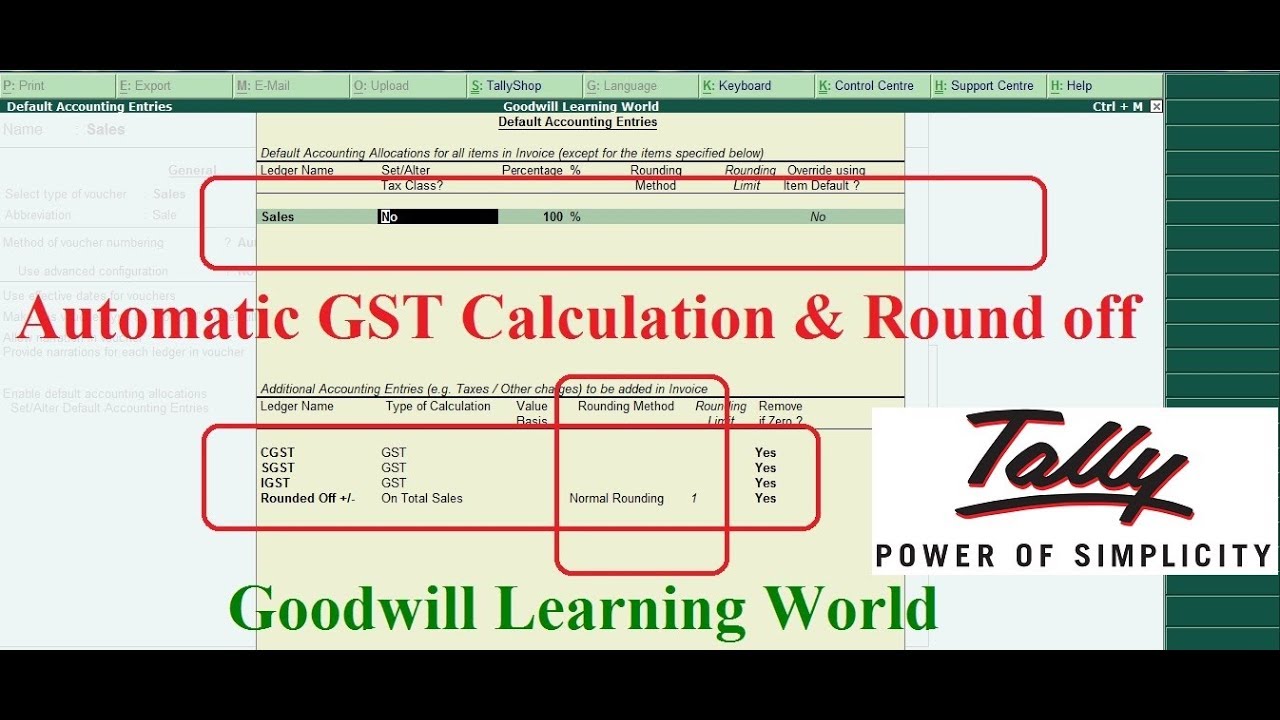

Tally Advance Configuration Auto Round Off And Auto Gst Calculation In Tally

Differentiate Between Vat And Sales Tax In 2022 Sales Tax Differentiation Tax

How To Calculate Vat In The Kingdom Of Saudi Arabia Vat In Uae Goods And Services Registration

Pin By Rajesh Doye On Gst India Goods And Services Tax General Knowledge Book Government Lessons Accounting And Finance

Value Added Tax Vat Infographic Value Added Tax Ads Tax